I am pleased to announce that The Consortium of Wealth Initiative is available to all the Harold Amos Medical Faculty Development Program ( AMFDP) alumni and associated medical professionals. This partnership between AMFDP and the Consortium of Wealth Initiative will allow AMFDP and similar career development programs to fulfill their mission of promoting Life Success for alumni. At AMFDP, we are strengthening our focus on practical life issues and are aware that the Wealth Gap is as real as the Health Gap.

This initiative will empower medical professionals to make comprehensive and strategic financial decisions that will positively impact their families for generations.

James R. Gavin, III, M.D., PhD

Our Mission

Our mission is to bring together “qualified” and “trained” financial planners, attorneys, CPAs, and other professionals to offer “holistic” planning that will provide a financial foundation for a successful life.

The concept of “comprehensive” financial planning has been lost in this era of overspecialization, as professionals typically stay siloed in their areas of expertise. At best, there is little to no coordination between professional advisors, and at worst, they are in competition. Piecing together a “comprehensive” plan using various professional advisors is time-consuming, confusing, and expensive.

Through this initiative, doctors and others who work in the medical field will be able to work with a coordinated team to implement a “complete” plan that they can have confidence in and will help them reach or even exceed their planning needs/goals.

Areas of Focus

1) Financial Education

- 10-module online financial literacy course

- Webinars

- E-newsletters

- Educational videos

- Monthly mentoring calls

2) Financial Empowerment

- 1:1 Coaching (with ongoing coaching available and recommended)

- Financial 2nd Opinions

- Access to industry experts (tax, financial, legal, etc.)

- Plan design (holistic, specific, comprehensive)

- Plan implementation (using a 9-step process from start to finish)

Roccy DeFrancesco, JD, CAPP, CMP

(Team Leader/Trainer/Mentor)

No platform such as this can be complete without a team leader. We are pleased to announce that Roccy DeFrancesco is on board to take on the role of team leader.

Click here to read Roccy’s bio.

Roccy duties will include:

- Designing training/educational content for consumers

- Educating/mentoring advisors

- Selecting and monitoring advisors allowed on the platform

- Being available for case design consultations

- Anything else that is needed to make this a successful endevor

Asset Protection (AP)

NO financial or estate plan can be complete without incorporating AP.

Unfortunately, very few advisors know much, if anything, about AP.

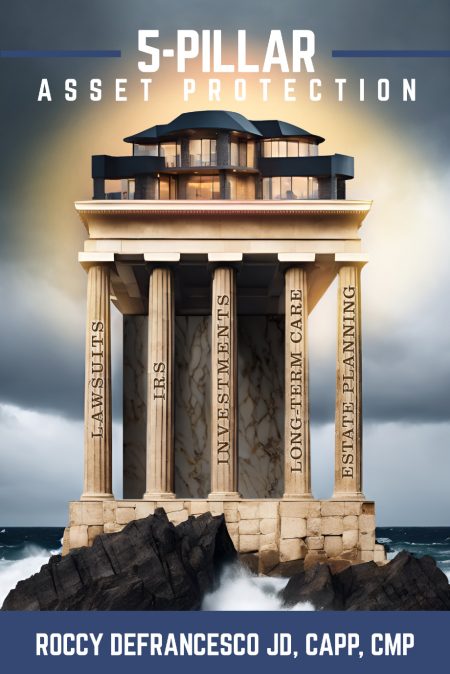

As you can see, Roccy has published a book on asset protection that covers 5-key piklars:

- Lawsuit protection

- Tax reduction (protection from the IRS)

- Stock market risk mitigation

- Protecting against long-term care costs

- Making sure your estate plan is fully in order

Coaching/Mentoring/Plan Design/Implementation Options

Silver Level ($500)

This Level includes education content and the ability to have questions answered on asset protection, estate planning, financial planning, or other important topics. This is a good entry point to start your journey to financial wellness.

- Access to online education (in all forms)

- Hard copy of 5-Pillar Asset Protection

- Determine if you have good/bad advisors

- 1-hour phone consult with Roccy ($500 retail)

Gold Level ($750)

This level includes Silver and is for those who want a formal assessment of their current situation. A written assessment will be provided and reviewed with you by an approved advisor.

- Review of your estate planning documents (or need for them if not completed)

- Review of your retirement income needs

- Review of current financial plan

- Assess the risk of your investments

- Determine if you are paying too much in taxes

- Determine your vulnerabilities to negligence lawsuits

- Review life, annuity, and DI contracts

Platinum Level ($1,000)

This level includes levels Silver and Gold and when your written assessment is delivered it will come along with specific recommendations to fix any flaws with your current plan (or lack thereof). A typical recommendation memo is 8-12 pages long.

- Specific steps to protect assets from creditors

- If needed, a "real" estate plan design

- Recommended tools to avoid large market downturns

- Recommendations on how to minimize taxes

- A completed financial plan including income for life planning.

- If needed, Roccy will join the call to go over your recommended plan!

Have questions about Silver, Gold, or Platinum?

Ongoing Coaching/Help

Professionals today are busier than ever. Work, family, and leisure take up so much time that many do not allocate time to work on their asset protection, financial, or estate plans. Many do not have a true “trusted” advisor or team they can reach out to answer questions for themselves or other family members.

Through this platform and network of advisors, we do offer ongoing coaching/help. If this is of interest, you can receive more information when you sign up for one of the levels outlined above. Our goal is to help people not only get their plans together today, but make sure they are updated and optimized on an annual basis.