The Retirement Income Gap

For many, the retirement income gap is real. What is it? It’s just what you think it is. It’s when your current financial plan will NOT provide for you the needed/required/desired income when you hit retirement.

Many people have a false sense of security (given to them by their “financial planner”)

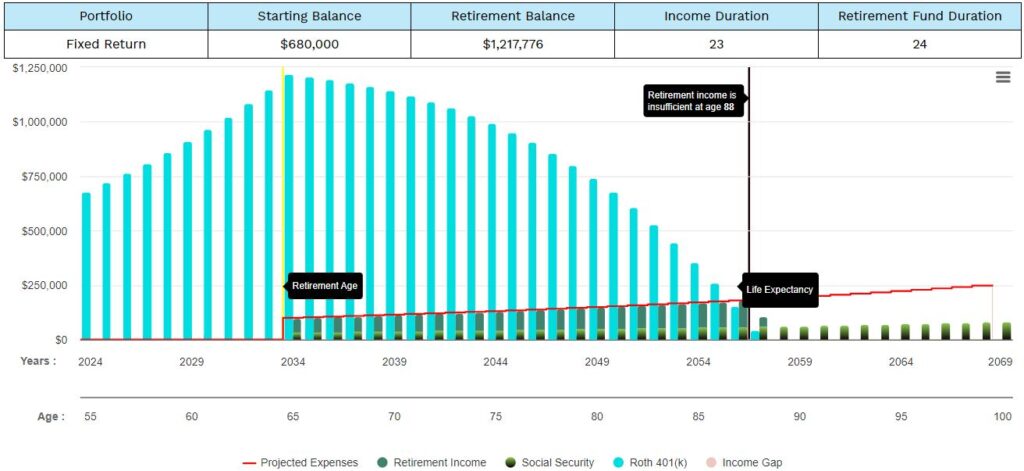

Let’s look at an example of a 55-year-old who thinks he is on track to retire with the cash flow he needs. As you can see in the following chart, he will run out of assets at his assumed age of death (age 88). Perfect right? Many people want to die with no money left.

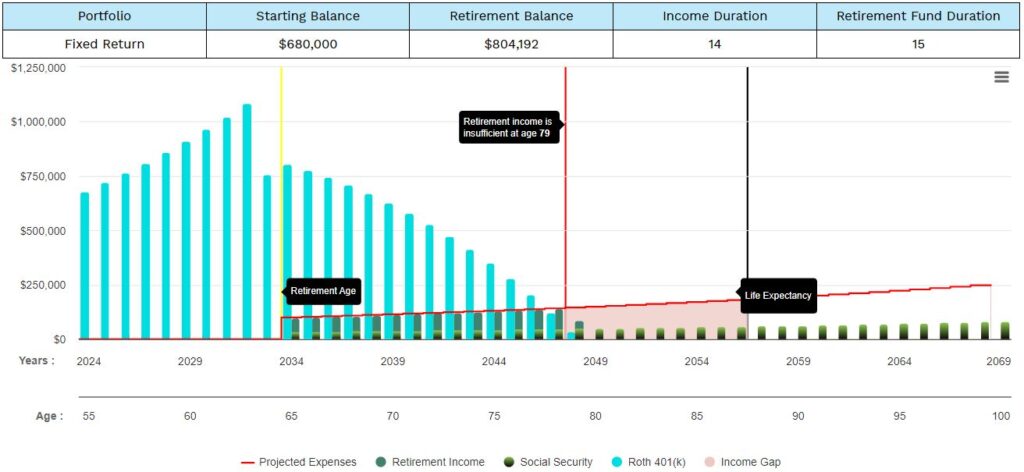

What if the portfolio in this example sustains a 30% negative return the year before retirement (age 65)?

He now runs out of money eight years early (look at the sizable retirement income gap)!

What if the market bounces back 30% the very next year in this retirement portfolio? He would still run out of money when he turns age 83.

Bouncing back from a large downturn in the market

When you are down 20%, you need +25% to get back to even. -30% requires +44%, -40% requires +66%, and -50% requires +100%.

The above and below charts illustrate why is it so important not to go backwards in a big way before or in retirement!

Tools to help mitigate negative stock market returns

Using a”buy-and-hold” investment philosophy is tough. Many people are not willing to hold their investments when the stock market is down 25%, 30%, 40%, 50%+ like we have seen over the last 30 years.

However, if you incorporate the use of risk-mitigation tools to limit negative returns, this can help hold your riskier equities without panic selling.

- Fixed Indexed annuity

- Structured Notes

- Retirement Life

- Tactical/active investment strategies (the opposite of buy-and-hold)

- Guaranteed income for life products

Let's make sure you don't run out of money in retirement!

Our goal when you engage our team is to put together a plan for you that helps you:

- Save the right amount of money (pre-retirement)

- Set up plans that are the most tax-efficient (so you don’t need to save as much pre-retirement)

- Stress-test planning scenarios so there is a high or very high likelihood of success

- Review the plan annually to make sure you stay on track